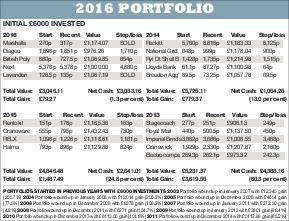

The loss of two profitable share tips took the edge off a sold all-round performance by our four investment portfolios last week. Both paving slabs group Marshalls and lifts specialist Lavendon triggered sell signals when their share prices dipped 10 per cent below recent peaks and we sold our notional holdings under the stop loss system. We believe both companies continue to offer good long term prospects but we take an extremely cautious view when any share falls out of stock market favour. Our rigid appliance of the stop loss rule follows heavy losses in the early years of our portfolio service when we held onto shares of fallen favourites such as RBS and BP in the forlorn hope of a recovery. But those with longer term horizons may take a more optimistic view and we could not argue if shareholders in Marshalls, in particular, hold on in anticipation of the 6.75p a share dividend due to those who retain the shares until after they go ‘ex-dividend’ on June 2. The latest sales mean that the 2016 portfolio holds almost 50 per cent of its assets in the form of cash. And the other three portfolios also have large reserves which make up an average of 33 per cent of their total value. We are conscious that this cash element is far too large in any but the most exceptional circumstances and it is likely we will test the market with one or two fresh selections in the coming weeks. Meantime, our existing tips held up well in another testing week with all four portfolios recording only fractional falls averaging around 0.4 per cent when we carried out our usual review on Wednesday morning. Most of our recommendations confined their movements to the odd penny or so in either directions although Lloyds Banking managed a useful rise as the government confirmed it will press on with a share sale in the next 10 months and fashion group Next continued its useful rally after earlier heavy selling. But Scottish transport giant Stagecoach shed another 5p over the week and is now within a whisker of triggering a sell signal under the stop loss rules.

Why are you making commenting on The Herald only available to subscribers?

It should have been a safe space for informed debate, somewhere for readers to discuss issues around the biggest stories of the day, but all too often the below the line comments on most websites have become bogged down by off-topic discussions and abuse.

heraldscotland.com is tackling this problem by allowing only subscribers to comment.

We are doing this to improve the experience for our loyal readers and we believe it will reduce the ability of trolls and troublemakers, who occasionally find their way onto our site, to abuse our journalists and readers. We also hope it will help the comments section fulfil its promise as a part of Scotland's conversation with itself.

We are lucky at The Herald. We are read by an informed, educated readership who can add their knowledge and insights to our stories.

That is invaluable.

We are making the subscriber-only change to support our valued readers, who tell us they don't want the site cluttered up with irrelevant comments, untruths and abuse.

In the past, the journalist’s job was to collect and distribute information to the audience. Technology means that readers can shape a discussion. We look forward to hearing from you on heraldscotland.com

Comments & Moderation

Readers’ comments: You are personally liable for the content of any comments you upload to this website, so please act responsibly. We do not pre-moderate or monitor readers’ comments appearing on our websites, but we do post-moderate in response to complaints we receive or otherwise when a potential problem comes to our attention. You can make a complaint by using the ‘report this post’ link . We may then apply our discretion under the user terms to amend or delete comments.

Post moderation is undertaken full-time 9am-6pm on weekdays, and on a part-time basis outwith those hours.

Read the rules here