Ruth Davidson has challenged the First Minister to commit to an independent economic assessment of her new tax proposals and raised concerns any rise would slow economic growth.

The Scottish Conservative leader was speaking at First Minister's Questions following the launch of the Scottish Government's paper on the role of income tax in the Scottish budget, which outlines alternative taxation plans which could see "modest" rises for higher earners.

Ms Davidson questioned if there would be a "full, independent and thorough economic assessment of any tax changes before they are undertaken", adding business leaders believe a tax rise in Scotland would slow down growth.

READ MORE: Nicola Sturgeon signals income tax hike for top earners

She said: "We all need to know if a tax rise will slow down growth in Scotland, compared to the rest of the UK."

She asked if, given one of the proposals in the government papers is to create six tax bands, "a new more complex tax system could create unintended consequences which detrimentally impact the amount of money raised".

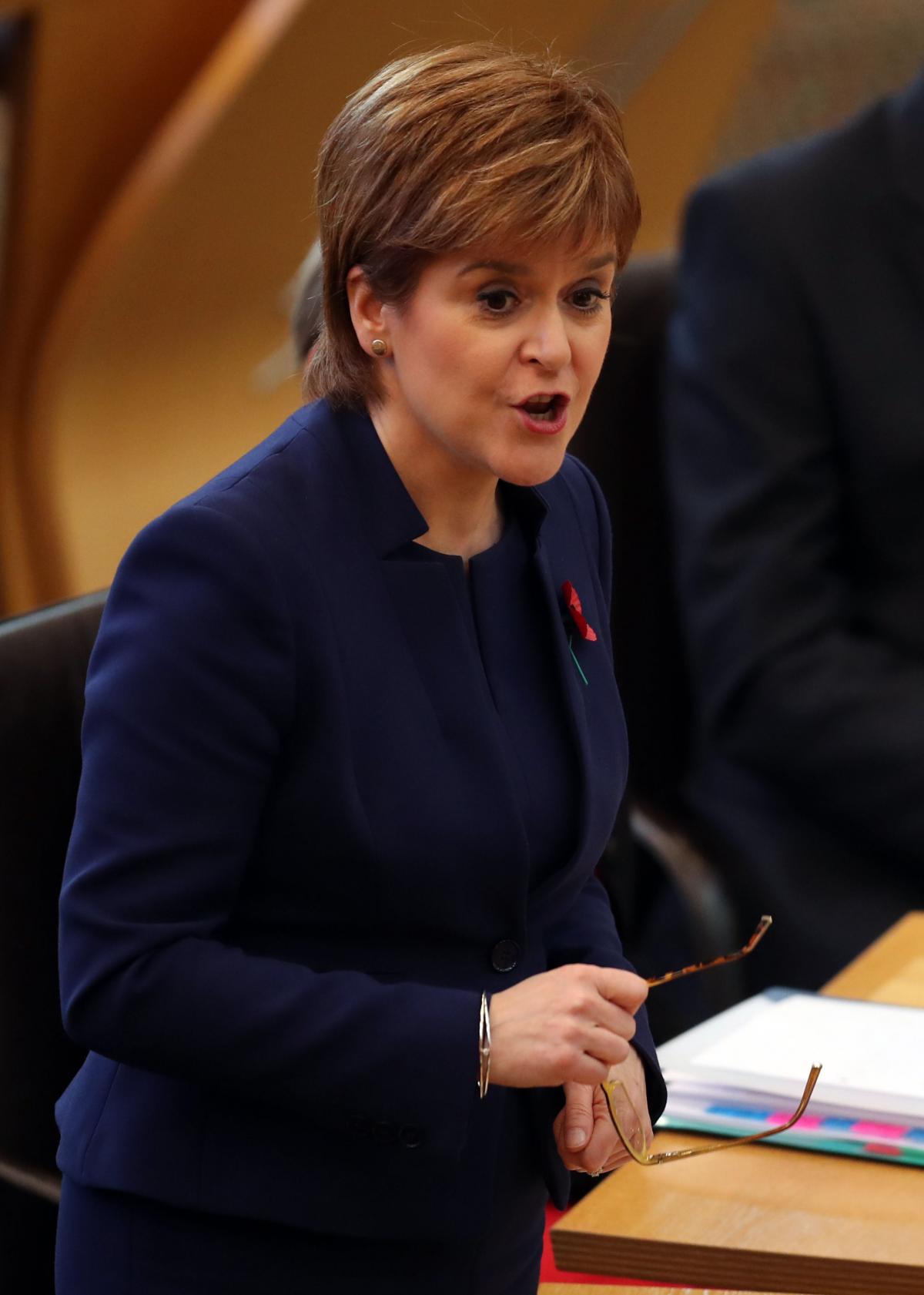

Nicola Sturgeon said the UK had "one of the most complex tax systems in the world" and having six tax bands was "not unusual" by international standards.

The First Minister stressed the need for balance, saying: "We need to look at this from the point of view of what kind of country do we want to be, what kind of economy do we want to have and what kind of society do we want?

"The competitiveness and the attractiveness of our economy is not just about our tax rates, important though that is, it's also about the quality of our public services, it's about the skills of our population, it's about the infrastructure we have as a country.

"Right now, Scotland has the highest quality public service provision anywhere in the UK, we have the most generous social contract anywhere in the UK and taking account of any of the potential options in the tax paper we have published today Scotland will remain the most cost effective place to be in the UK."

READ MORE: Nicola Sturgeon signals income tax hike for top earners

She continued: "The Tories' proposal analysed in this paper is to give a tax cut to the top 10% of earners in the country which would take £140 million out of the Scottish budget.

"Ruth Davidson and the Conservatives have to explain how they would pay for that and who would bear the burden of that."

Ms Davidson replied: "The reasons that we support a competitive tax regime is because that will develop Scotland's economy, boosting the income tax that we need for our schools and hospitals.

"We don't think it's right that any Scot earning more than £24,000 should have to pay more.

"The bottom line here is about getting growth and we are lagging behind. Scotland's economy is currently growing a third of the rate of the UK."

Scottish Labour's Jackie Baillie said she welcomed a focus on progressive taxation, however she said the Government's tax options would not be enough to end austerity.

Labour's proposes increasing the basic rate and higher rate tax rate by 1p, and an increase in the additional rate to 50p.

The Government's own paper estimates that such changes could raise between £550 million and £630 million in extra revenue in one year.

"To end austerity you need to raise more than £800 million in revenue over the next two years, that's before we consider additional commitments," Ms Baillie said.

"Yet the Government's proposals published today in the tax paper raises a maximum of £290 million - that doesn't even come closing the gap, there is a black hole in the budget and more services would end up being cut."

READ MORE: Nicola Sturgeon signals income tax hike for top earners

Ms Baillie - standing in for interim leader Alex Rowley at FMQs - said the promised public sector pay rise would also have to be funded, questioning where that money would come from.

"We have before us a tax plan that doesn't add up and a list of commitments she (Ms Sturgeon) know she can't pay," she said.

The First Minister said: "We have set out here a range of possible options - there may be other options that parties want to bring forward - but let's go into this discussion in the spirit of trying to find consensus that is the interests of our society, public services and our economy."

Greens co-convener Patrick Harvie, whose party backs an overhaul of income tax rates and bands, said: "Isn't it clear now that the no-change option that the SNP put forward is off the table, an increase in the basic rate is off the table, and the Green option of a fairer range of rates and bands is the only serious option left standing."

READ MORE: Nicola Sturgeon signals income tax hike for top earners

He added: "It's very clear that the only way the Scottish Government can pass a budget this year is by raising enough revenue for public priorities like an inflation-based increase in public sector pay, but to do it fairly in a way that reduces inequality."

Why are you making commenting on The Herald only available to subscribers?

It should have been a safe space for informed debate, somewhere for readers to discuss issues around the biggest stories of the day, but all too often the below the line comments on most websites have become bogged down by off-topic discussions and abuse.

heraldscotland.com is tackling this problem by allowing only subscribers to comment.

We are doing this to improve the experience for our loyal readers and we believe it will reduce the ability of trolls and troublemakers, who occasionally find their way onto our site, to abuse our journalists and readers. We also hope it will help the comments section fulfil its promise as a part of Scotland's conversation with itself.

We are lucky at The Herald. We are read by an informed, educated readership who can add their knowledge and insights to our stories.

That is invaluable.

We are making the subscriber-only change to support our valued readers, who tell us they don't want the site cluttered up with irrelevant comments, untruths and abuse.

In the past, the journalist’s job was to collect and distribute information to the audience. Technology means that readers can shape a discussion. We look forward to hearing from you on heraldscotland.com

Comments & Moderation

Readers’ comments: You are personally liable for the content of any comments you upload to this website, so please act responsibly. We do not pre-moderate or monitor readers’ comments appearing on our websites, but we do post-moderate in response to complaints we receive or otherwise when a potential problem comes to our attention. You can make a complaint by using the ‘report this post’ link . We may then apply our discretion under the user terms to amend or delete comments.

Post moderation is undertaken full-time 9am-6pm on weekdays, and on a part-time basis outwith those hours.

Read the rules hereLast Updated:

Report this comment Cancel