Three stars of BBC sitcom Mrs Brown’s Boys, Formula One world champion Lewis Hamilton and Apple are the latest to be named in the Paradise Papers leaks into tax-avoidance schemes.

Patrick Houlihan, Martin Delany and Fiona Delany – who is the daugher of the show’s creator and star Brendan O’Carroll – are said to have diverted more than £2 million into an offshore tax-avoidance scheme.

Hamilton is said to have received a £3.3m VAT refund on his distinctive red £16.5m Bombardier Challenger private jet after it touched down briefly on the Isle of Man following the purchase in January 2013.

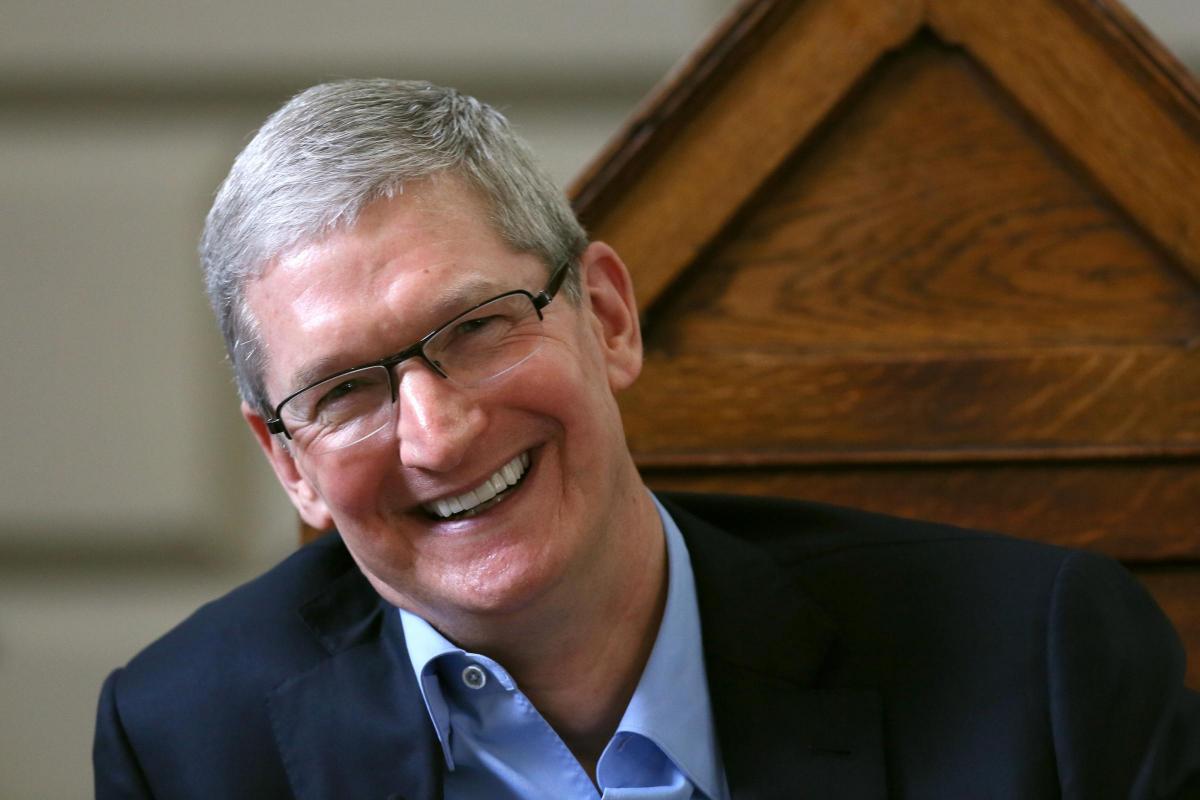

Global tech firm Apple, whose high- profile chief executive officer is Tim Cook, is also said to have been embroiled in avoidance arrangements.

According to the papers, it had sidestepped a 2013 crackdown on its controversial Irish tax practices by actively shopping around for a tax haven.

Paradise Papers: Celtic shareholder Dermot Desmond's private jet firm 'used offshore tax haven'

More than 13 million documents have been leaked from the offshore law firm Appleby as part of a global media project – dubbed the Paradise Papers – exposing secretive overseas arrangements of a number of politicians, celebrities, corporate giants and business leaders.

Yesterday, the BBC revealed a number of figures involved in schemes.

It found Apple held most of its untaxed offshore cash, now $252bn, in the Channel Island of Jersey.

However, Apple said the new structure had not lowered its taxes.

It said it remained the world’s largest taxpayer, paying about $35bn (£26bn) in corporation tax over the past three years, that it had followed the law and its changes “did not reduce our tax payments in any country”.

Up until 2014, the company had been exploiting a loophole in tax laws in the US and the Republic of Ireland known as the “double Irish”.

This allowed Apple to funnel all its sales outside of the Americas – currently about 55 per cent of its revenue – through Irish subsidiaries that were effectively stateless for taxation purposes, and so incurred hardly any tax.

In Hamilton’s case, it reported a leasing deal set up by advisers was artificial and did not comply with an EU and UK ban on refunds for private use –although he may have been entitled to one for business.

The Mercedes driver’s lawyers say a tax barrister review found the structure was lawful. They added it was not correct to say no VAT had been paid on any of the arrangements.

Lawyers told the BBC the driver has a “set of professionals in place who run most aspects of his business operations and that no subterfuge or improper levels of secrecy had been put in place”.

Paradise Papers: Celtic shareholder Dermot Desmond's private jet firm 'used offshore tax haven'

He has frequently posted pictures of himself, and even his dogs, on board the Challenger jet in a number of exotic locations around the world.

In light of the Paradise Papers revelations, the Isle of Man government is said to have invited the UK Treasury to conduct an assessment of the practice of importing aircraft into the EU through the island.

Mrs Brown’s Boys stars, the three stars are said to have diverted more than £2m of their fees into companies in Mauritius and sent money back as loans.

Documents allegedly show money paid into a UK firm by the production company was transferred to Mauritius companies through a trust which took 12.5 per cent.

These companies, said to be under the actors’ control, then used a third party to pay loans into the three actors’ personal UK bank accounts, it is claimed.

O’Carroll, the creator and star of the show and real-life father of Fiona Delany, said neither he nor his companies had been involved in a tax avoidance scheme or structure.

Mr Houlihan told the Irish Times he did not fully understand the scheme, and that he had to Google what tax avoidance was when he was contacted by a BBC reporter.

Guidance released in summer 2016 from HM Revenue and Customs warned that it can tax loans paid to contractors or freelance workers through trusts or umbrella companies, just like normal income.

“In reality, you don’t pay the loan back, so it’s no different to normal income and is taxable,” the guidance said.

Roy Lyness, who put the stars in touch with the advisers behind the set-up, was the accountant behind the similar tax avoidance scheme used by comedian Jimmy Carr.

Why are you making commenting on The Herald only available to subscribers?

It should have been a safe space for informed debate, somewhere for readers to discuss issues around the biggest stories of the day, but all too often the below the line comments on most websites have become bogged down by off-topic discussions and abuse.

heraldscotland.com is tackling this problem by allowing only subscribers to comment.

We are doing this to improve the experience for our loyal readers and we believe it will reduce the ability of trolls and troublemakers, who occasionally find their way onto our site, to abuse our journalists and readers. We also hope it will help the comments section fulfil its promise as a part of Scotland's conversation with itself.

We are lucky at The Herald. We are read by an informed, educated readership who can add their knowledge and insights to our stories.

That is invaluable.

We are making the subscriber-only change to support our valued readers, who tell us they don't want the site cluttered up with irrelevant comments, untruths and abuse.

In the past, the journalist’s job was to collect and distribute information to the audience. Technology means that readers can shape a discussion. We look forward to hearing from you on heraldscotland.com

Comments & Moderation

Readers’ comments: You are personally liable for the content of any comments you upload to this website, so please act responsibly. We do not pre-moderate or monitor readers’ comments appearing on our websites, but we do post-moderate in response to complaints we receive or otherwise when a potential problem comes to our attention. You can make a complaint by using the ‘report this post’ link . We may then apply our discretion under the user terms to amend or delete comments.

Post moderation is undertaken full-time 9am-6pm on weekdays, and on a part-time basis outwith those hours.

Read the rules hereLast Updated:

Report this comment Cancel