Royal Bank of Scotland has been officially ranked Britain’s worst bank by consumers and businesses, according to data released by regulators.

The taxpayer-owned bank came bottom of league tables published by the Competition & Markets Authority (CMA), based on a survey of personal and business banking customers.

RBS is joint bottom of the personal banking league table alongside Clydesdale, with less than half of customers saying they would recommend the lender.

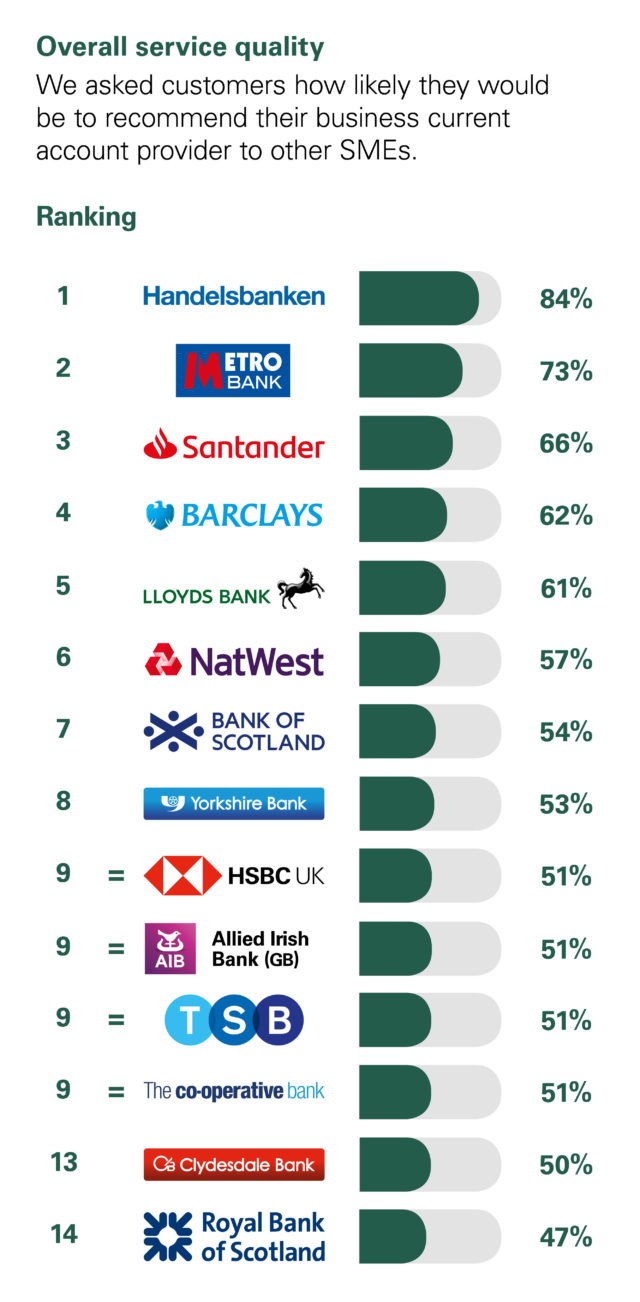

It also came out bottom for business banking.

RBS has been dogged by several scandals since its Government bailout in 2008, including for the mistreatment of small businesses and most recently a bank branch closure drive.

- READ MORE: RBS pays dividend to shareholders while being hit for £3.8bn for financial crisis misconduct

A spokesman for the bank said: “We are aware we have more work to do in order to improve our service standards and deliver a better experience for our customers.

“That is why we are investing in improving the products and services we offer our personal and business customers, whether that’s through launching initiatives such as the UK’s first paperless mortgage or ESME, our digital lending platform for SMEs, which are helping us to deliver better service for our customers.”

First Direct came top of the personal banking league table with 85% of customers satisfied, while Handelsbanken topped the business ranking with 84%.

Under new rules that came into force on Wednesday, banks must publish information on how likely people would be to recommend them – including online and mobile banking, branch and overdraft services – to friends, relatives or other businesses.

The results must be displayed prominently in branches as well as on websites and apps.

The CMA said it will make it easier for people to find out if another bank has a better offer and will drive up competition.

- READ MORE: RBS pays dividend to shareholders while being hit for £3.8bn for financial crisis misconduct

Adam Land, senior director at the CMA, said: “For the first time, people will now be able to easily compare banks on the quality of the service they provide, and so judge if they’re getting the most for their money or could do better elsewhere.

“This is one of the many measures – including Open Banking and overdraft text alerts – that we put in place to make banks work harder for their customers and help people shop around to find the best deals for them.”

Why are you making commenting on The Herald only available to subscribers?

It should have been a safe space for informed debate, somewhere for readers to discuss issues around the biggest stories of the day, but all too often the below the line comments on most websites have become bogged down by off-topic discussions and abuse.

heraldscotland.com is tackling this problem by allowing only subscribers to comment.

We are doing this to improve the experience for our loyal readers and we believe it will reduce the ability of trolls and troublemakers, who occasionally find their way onto our site, to abuse our journalists and readers. We also hope it will help the comments section fulfil its promise as a part of Scotland's conversation with itself.

We are lucky at The Herald. We are read by an informed, educated readership who can add their knowledge and insights to our stories.

That is invaluable.

We are making the subscriber-only change to support our valued readers, who tell us they don't want the site cluttered up with irrelevant comments, untruths and abuse.

In the past, the journalist’s job was to collect and distribute information to the audience. Technology means that readers can shape a discussion. We look forward to hearing from you on heraldscotland.com

Comments & Moderation

Readers’ comments: You are personally liable for the content of any comments you upload to this website, so please act responsibly. We do not pre-moderate or monitor readers’ comments appearing on our websites, but we do post-moderate in response to complaints we receive or otherwise when a potential problem comes to our attention. You can make a complaint by using the ‘report this post’ link . We may then apply our discretion under the user terms to amend or delete comments.

Post moderation is undertaken full-time 9am-6pm on weekdays, and on a part-time basis outwith those hours.

Read the rules hereLast Updated:

Report this comment Cancel