HUNDREDS of jobs in Scotland could be affected after Debenhams announced record losses and said a third of its stores have no long term future, despite the individual stores being in profit.

The group swung to a £491.5 million loss in the year to September, and said the closures of 50 shops will take place in the next three to five years placing 4,000 UK jobs under threat.

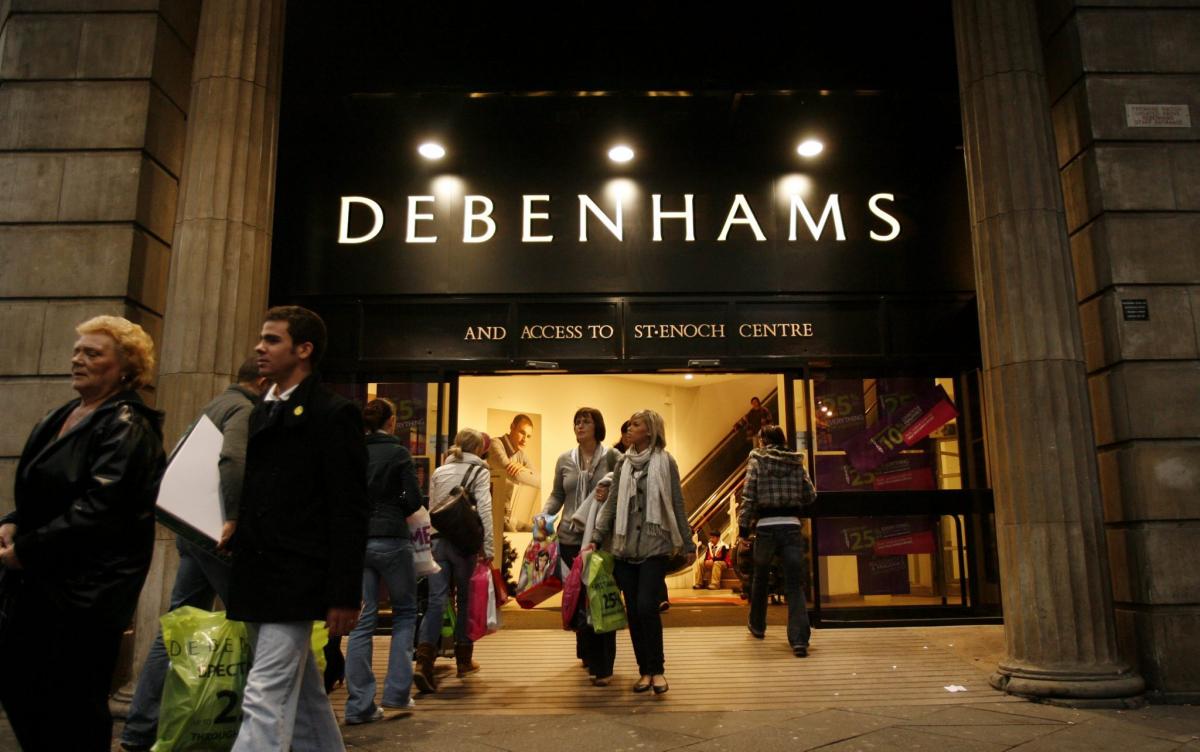

The company has 14 stores in Scotland, including in Glasgow, above, Edinburgh and Aberdeen, and although it declined to say how many employees it has north of the border it is thought as many as five stores and hundreds of workers could be affected.

Prior to the accounting adjustments, underlying profit before tax was £33.2m, still well below £59m profit in 2017.

The firm said it plans to close stores that are in profit but where it does "not see a long term future".

Sergio Bucher, the firm's chief executive, said: “We are taking tough decisions on stores where financial performance is likely to deteriorate over time.”

The store closures will reduce the Debenhams estate to about 100.

The update revealed that sales for the year slipped 1.8 per cent to £2.9 billion while like-for-like revenue fell 2.3%.

Mr Bucher said: “Debenhams remains a strong and trusted brand with 19m customers shopping with us over the past year.

“With a strengthened balance sheet, we will focus investment behind our strategic priorities and ensure that Debenhams has a sustainable and profitable future.

“I can promise my 26,000 staff across the UK that we will work very hard to protect as many stores and as many jobs as we can.”

A Debenhams spokesperson said: “We have identified up to 50 stores, accounting for under 15% of total sales, which are currently profitable, but where we do not see a long term future and which we intend to exit over the next three to five years

"This is an ongoing five year programme and we are not disclosing a list of these stores.”

Troubles at Debenhams coms as a raft of retailers including New Look, Carpetright and Mothercare embark on store closures programmes.

Debenhams is already at the centre of takeover speculation, with Mike Ashley, who owns just under 30% of the store, also having recently acquired House of Fraser.

Manu Tyagi, associate partner at Infosys Consulting, said the high street can thrive: "In-store sales revenues and operational issues are often cited as the main factors behind the squeeze on department stores.

"However, other retailers like Selfridges, Harrods, and Harvey Nichols tell a different story, they have not just survived but are thriving in the internet age.

"The most likely answer is that retailers are struggling because they have lost sight of how important the customer experience can be.

"For department stores struggling to combat the relentless march of online retail, the key is to use technology to enhance, not replace, the traditional shopping experience."

However, Richard Lim, of Retail Economics, said many stores like Debenhams "operate in a part of the market under the most intense amount of pressure" and are simply too expensive to run.

- Read more: New finance chief for retailer Debenhams

Laith Khalaf, senior analyst at Hargreaves Lansdown, said: "The Debenhams share price has lost four fifths of its value in the last year, and no doubt some will be wondering if we are now near the bottom.

"Despite the dramatic drop, this is still a business in a state of transition, and while the upside could be considerable if Debenhams turns things around, there is still a risk of further losses, particularly given the fragile and dynamic consumer environment.

"Debenhams should be viewed as a recovery play for adventurous investors, with a tolerance for loss and the patience to see things get worse before they get better.’

Why are you making commenting on The Herald only available to subscribers?

It should have been a safe space for informed debate, somewhere for readers to discuss issues around the biggest stories of the day, but all too often the below the line comments on most websites have become bogged down by off-topic discussions and abuse.

heraldscotland.com is tackling this problem by allowing only subscribers to comment.

We are doing this to improve the experience for our loyal readers and we believe it will reduce the ability of trolls and troublemakers, who occasionally find their way onto our site, to abuse our journalists and readers. We also hope it will help the comments section fulfil its promise as a part of Scotland's conversation with itself.

We are lucky at The Herald. We are read by an informed, educated readership who can add their knowledge and insights to our stories.

That is invaluable.

We are making the subscriber-only change to support our valued readers, who tell us they don't want the site cluttered up with irrelevant comments, untruths and abuse.

In the past, the journalist’s job was to collect and distribute information to the audience. Technology means that readers can shape a discussion. We look forward to hearing from you on heraldscotland.com

Comments & Moderation

Readers’ comments: You are personally liable for the content of any comments you upload to this website, so please act responsibly. We do not pre-moderate or monitor readers’ comments appearing on our websites, but we do post-moderate in response to complaints we receive or otherwise when a potential problem comes to our attention. You can make a complaint by using the ‘report this post’ link . We may then apply our discretion under the user terms to amend or delete comments.

Post moderation is undertaken full-time 9am-6pm on weekdays, and on a part-time basis outwith those hours.

Read the rules here