IT IS often said that active managers cannot outperform US equity index the S&P 500. I wholeheartedly disagree.

The argument goes that the US is too efficient a market for active managers to add value, but all the evidence is to the contrary. The US is wonderfully inefficient and home to many exceptional companies growing at multiples of the average S&P 500 constituent.

Research by Hendrik Bessembinder, Professor at Arizona State University, found just four per cent of stocks have accounted for more than half the total stock market wealth creation in the US over the past 90 years.

His findings show the importance of backing the few truly outstanding businesses - 86 stocks account for $16 trillion in wealth creation over this time period. Increasingly, we are finding some of the best opportunities aren’t just outside of the S&P 500, but not listed on any stock exchange.

Companies are choosing to stay private for longer. Often many of these businesses are capital light, with significantly less reliance on funding to fulfil their growth potential. They realise much of their transformational growth before listing, providing rich opportunities for investors that can gain access at these early stages.

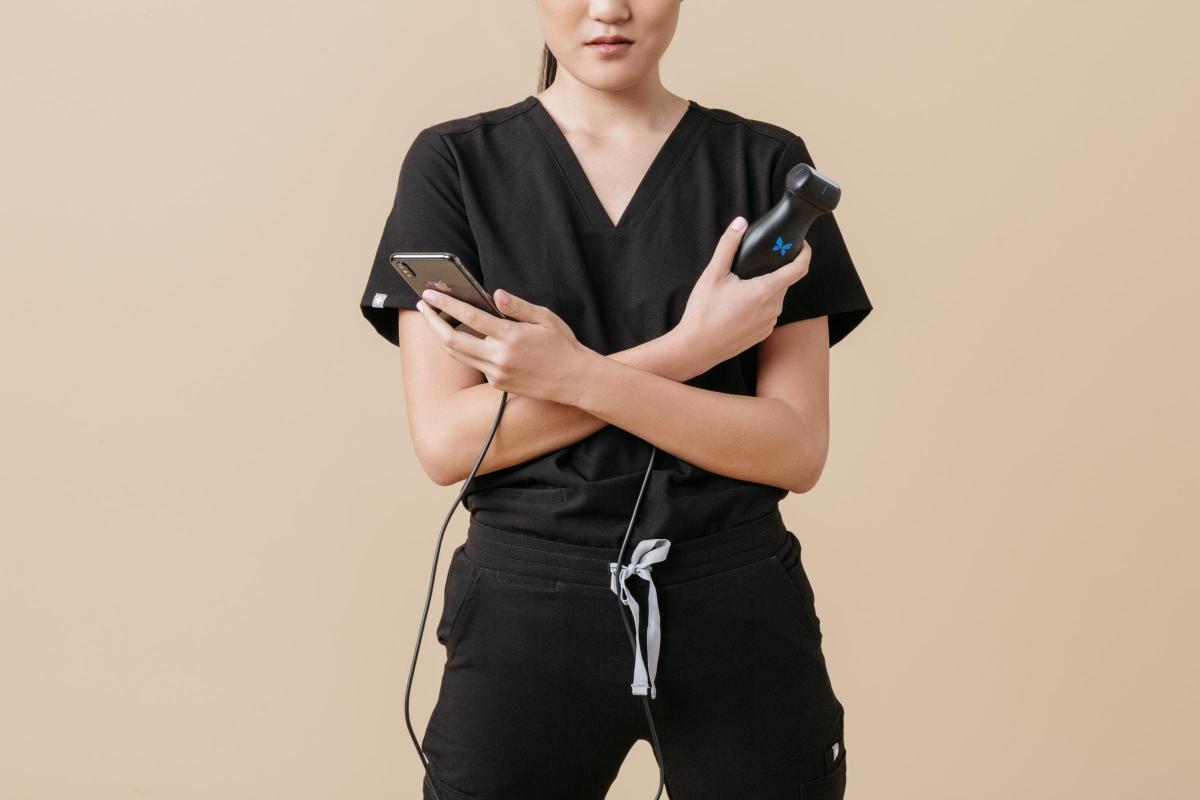

We are supporting an increasing number of these companies. One example is Butterfly Network. Butterfly has the potential to be a disruptive force in the medical-imaging industry through redesigning ultrasound from the bottom up using semiconductor technology. In doing so, it has produced a product that is smaller, cheaper and more powerful than traditional ultrasound machines.

The device plugs in to an iPhone and, using artificial intelligence, is able to guide a physician to capture an image and then, in an increasing number of cases, process that image in order to enhance the diagnosis quality. It costs $2,000, a fraction of the price of equivalents, and could lead to increased access to medical imaging in both developed and developing markets.

Another of our unlisted holdings, Indigo Agriculture, is transforming the agricultural industry through microbiology and data science. It has found a way to increase crop yields by coating seeds in naturally occurring materials, with the objective of improving farmer profitability and providing a strong uplift of business performance for suppliers who adopt Indigo’s innovative technology.

SpaceX, Elon Musk’s space exploratory brainchild, is one of highest-profile private stocks we hold, but further highlights the exceptional growth potential we strive to support. SpaceX designs, manufactures and launches advanced rockets and spacecraft, and by fully embracing innovation and vertical integration, the company has opened up a series of cost and capability improvements that are transforming the space industry.

Such remarkable innovations require patient, supportive and long-term shareholders, and a closed-ended investment structure suited to unlisted holdings. Private companies often have longer time horizons for their visions to bear fruit, and investment trusts allow managers to continue supporting these illiquid investments without pressure to sell at the wrong moment in a company’s journey.

Asymmetry plays a critical role in driving long-term stock market returns. The pattern of returns we have seen historically may turn out to be even more pronounced in future, given the pace of change affecting many industries. The gaps between the winners and losers are more likely to widen than shrink. The disruption enabled by the emergence of new technologies started in a few select industries, but is spreading more broadly.

We are now seeing digital, mobile and machine-learning technologies applied in industries across the spectrum. Many private companies are at the forefront of these developments, and offer huge opportunities to deliver long-term capital growth.

Helen Xiong is co-manager of the Baillie Gifford US Growth Trust.

Why are you making commenting on The Herald only available to subscribers?

It should have been a safe space for informed debate, somewhere for readers to discuss issues around the biggest stories of the day, but all too often the below the line comments on most websites have become bogged down by off-topic discussions and abuse.

heraldscotland.com is tackling this problem by allowing only subscribers to comment.

We are doing this to improve the experience for our loyal readers and we believe it will reduce the ability of trolls and troublemakers, who occasionally find their way onto our site, to abuse our journalists and readers. We also hope it will help the comments section fulfil its promise as a part of Scotland's conversation with itself.

We are lucky at The Herald. We are read by an informed, educated readership who can add their knowledge and insights to our stories.

That is invaluable.

We are making the subscriber-only change to support our valued readers, who tell us they don't want the site cluttered up with irrelevant comments, untruths and abuse.

In the past, the journalist’s job was to collect and distribute information to the audience. Technology means that readers can shape a discussion. We look forward to hearing from you on heraldscotland.com

Comments & Moderation

Readers’ comments: You are personally liable for the content of any comments you upload to this website, so please act responsibly. We do not pre-moderate or monitor readers’ comments appearing on our websites, but we do post-moderate in response to complaints we receive or otherwise when a potential problem comes to our attention. You can make a complaint by using the ‘report this post’ link . We may then apply our discretion under the user terms to amend or delete comments.

Post moderation is undertaken full-time 9am-6pm on weekdays, and on a part-time basis outwith those hours.

Read the rules here