SCOTTISH shell firms were used to launder tens of millions of dollars looted from Ukraine by the country's former leaders, the Sunday Herald can reveal. Off-the-shelf businesses registered in Scotland have long played a key role in successive global multi-billion-pound schemes to clean dirty money from the former Soviet Union.

Now a major new cache of bank and court records obtained by investigators at the Al Jazeera TV station has exposed the first direct links between Scottish firms and the known money-laundering fronts of corrupt oligarchs enriched under ousted Ukrainian President Viktor Yanukovych.

Raw data obtained by Al Jazeera and shared with The Sunday Herald includes bank statements detailing scores of payments made from the accounts of shell companies registered in Glasgow, Edinburgh, Fife and Aberdeenshire, to offshore firms formally named as money-laundering vehicles for what Ukrainians call the Yanukovych "family".

President Yanukovych, widely regarded by both his opponents and international observers as being corrupt, has always denied any ownership of foreign firms.

He fled to Russia after he was overthrown in the Maidan Revolution of 2014. In doing so, he abandoned a lavish palace he had built for his family, the Mezhyrhirya Residence near the Ukrainian capital Kiev, complete with an ostrich farm, a collection of exotic cars and a solid gold loaf of bread.

Yanukovych’s associates, however, left behind something more useful for corruption investigators, a paper trail of documents, enough for some $1.5 billion worth of assets, mostly government bonds, to be frozen from his wider clan.

Court documents relating to this seizure – which is being legally contested by Yanukovych associates who claim their money is clean – remain shrouded in secrecy. However, Qatar-based Al Jazeera has obtained the paperwork, throwing open what experts say is a highly sophisticated pipeline for getting money out of Ukraine, one of Europe’s poorest countries.

Using Al Jazeera’s raw documentation, The Sunday Herald has identified suspect payments of some $50m from a series of Scottish-registered firms to just two of the hundreds of corporate entities listed in court documents as fronts for Yanukovych associates. Most of the Scottish firms are limited partnerships or SLPs whose owners for years were allowed to remain secret, file no accounts and pay no taxes.

Such businesses, dubbed “Britain’s home-grown secrecy vehicle” by anti-corruption campaigners Transparency International, have already been exposed as core elements of two of the biggest and most elaborate money-laundering schemes ever uncovered, the Russian and Azerbaijani Laundromats.

However, the Russian, Azerbaijani and now Ukrainian schemes all also make use of other British corporate entities, including Scottish and English limited liability partnerships or LLPs.

This has sparked growing concern that Britain’s wider soft-touch corporate regime – combined with laissez-faire banking in the Baltic states and elsewhere – were providing the “getaway cars” for the oligarchs and criminals robbing the former Soviet Union.

Alison Thewliss (pictured above), an SNP MP, has been campaigning in the House of Commons for tighter controls over Scottish and English shell firms which are effectively able to act as outwardly respectable secrecy vehicles.

Thewliss said: “The apparent abuse of Scottish Limited Partnerships and LLPs to launder money ought to be of huge concern to the UK Government.

"When a deliberately secretive and shady series of financial transactions lead to addresses in Scotland, action must be taken. It would appear that that SLPs in particular have become a key component to international criminality. The UK Government must not ignore international money laundering on our doorstep."

The Al Jazeera documents all relate to a single but giant controversy: the effective seizure and control of almost Ukraine's entire gas industry by an associate of Yanukovych called Serhiy Kurchenko when he was still in his 20s.

Now 32, Kurchenko, sometimes called Ukraine's "wizard of gas", is in Moscow after fleeing corruption and tax evasion charges at home.

The fugitive billionaire, a substantial investor despite being subject to individual EU sanctions, currently dashes between government buildings in the Russian capital in an motorcade of armoured luxury vehicles, according to candid filming by Al Jazeera.

Kurchenko's network of businesses, under the umbrella of a firm called VETEK, erupted on to the thoroughly opaque Ukrainian energy market when he was just 27, in 2012.

The former head of the Ukrainian parliament's anti-corruption committee, Viktor Chumak, in the heady early days after the Maidan revolution, spelled out Kurchenko's local reputation. He told Reuters: "Everybody in Ukraine knows that he is the wallet to pay off Yanukovych." Other Ukrainian officials have referred to Kurchenko as the manager or "chief financial officer" of the Yanukovych family.

(Picture courtesy of Al Jazeera)

The billionaire himself – whose personal empire was to include his hometown football club of Kharkiv Metallist until it was stripped from him in October – has always denied that he is a front man for the Yanukovych family. "I am an honest Ukrainian businessman,” Kurchenko said in a rare public statement after arrest warrants were issued for him in 2014.

Shortly after Yanukovych's ouster Ukrainian authorities froze $1.5 billion from a company in the VETEK network called Gazukraina-2020. Its "nominal" director, Arkadiy Kashkin, was later convicted of "fictitious entrepreneurship" and fined. He was, Ukrainian media said, just a patsy for Kurchenko and Yanukovych.

Last March a court in Kramatorsk, a city close to the frontline with the breakaway pro-Russian republic set up in Yanukovych's hometown of Donetsk, formally seized the $1.5 billion in the Kashkin case.

The court's judgment has not been published but has been obtained by Al Jazeera and shared with The Sunday Herald. It includes a list of offshore firms named as laundering vehicles, some of which are suing for the return of their assets.

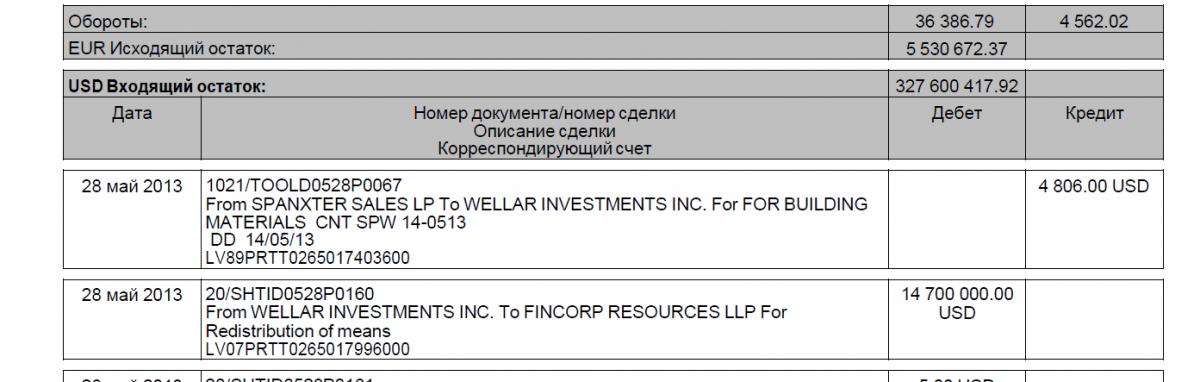

The Sunday Herald has seen the statements at the Latvian branch of Ukraine's Privatbank for two of these named vehicles, Wellar Investments Inc of Belize and Folkbrook Incorporated.

They show them receiving payments from seven SLPs, all now dissolved, from Glasgow, Edinburgh, and Huntly in Aberdeenshire, and three LLPs, two nominally based in Edinburgh and one in Rosyth, Fife.

One of the LLPs, Waverton Sales, registered at a mail drop business in the capital's Rose Street, paid roughly $27m or £20m at today's exchange rates, into Folkbrook's account in Latvia between February 2013 and February 2014, when Kurchenko and Yanukovych escaped to Russia. All those payments were listed as for "home electronics" – that's enough to buy 80,000 Playstation consoles. At one point Waverton Sales was regularly paying half a million a day.

Yet accounts filed at Companies House show the business, which was closed in August 2016, as dormant with no assets, no cash and no stocks. Waverton Sales listed its partners as two firms in tax havens, one in the Seychelles in the Indian Ocean and one in the Marshalls in the Pacific. There is no way of contacting the ultimate beneficial owners of Waverton, as this is not known.

Authorities in Latvia, meanwhile, have also acted against Folkbrook, seizing $2.8m from a Privatbank account in Riga in August 2016. Privatbank said it complies with anti-money-laundering rules. It has, however, previously been fined by its regulator for breaching them.

An SLP called Spanxter Sales, which was formally based at an Edinburgh flat before it was dissolved last year, paid $17.5m to Wellar Investments for building materials, bank statements show. Spanxter, as an SLP, did note need to file accounts. But it has left no real-world or digital footprint showing any construction or other business activity in Scotland or elsewhere. Spanxter's true owners are unknown and uncontactable.

English LLPs are also paid in to accounts for Wellar and Folkbrook. Money was also from their accounts to English firms and at least one SLP. One shell firm to receive money from Wellar's account was Fincorp Resources, an English LLP subject to the same confiscation order in Latvia as Folkbrook. It was dissolved last summer.

Money-laundering experts have long stressed the way in which multiple layers of shell firms, nestled inside each other like Russian matryoshka dolls, can obscure true ownership.

Writer Oliver Bullough, author of a forthcoming book exposing global tax evasion called Moneyland, explained: "The more plastic bags you wrap around a dog turd, the harder it is for outsiders to realise what’s inside. And if the last bag says Tiffany & Co on it, perhaps no-one will ever realise it’s full of sh*t."

For years SLPs were openly sold off the shelf in the former Soviet Union as "zero-tax Scottish offshore companies" for as little as £1,500 each, complete with a nominal address and power of attorney over their theoretical partners, usually in tax havens like Panama or the Marshall Islands. British LLPs and limited companies were also marketed in the same way.

The UK Government, under pressure from the SNP and a wider Scottish campaign, last year imposed new transparency rules on SLPs – meaning such entities have to name a person of significant control or PSC.

Many have shrugged off the new anti-corruption regime, which had already been applied to LLPs and limited companies. A handful, however, have complied and named a real person, according to research by our sister paper, The Herald. Of those that did, three-quarters were from the former Soviet Union. And what was the biggest single country of origin for SLPs owners? Ukraine.

Al Jazeera's investigation is broadcast on Sunday, January 7 at 8pm

THE LOOTING OF A NATION

Ukraine is in trouble. One its regions, the Crimean peninsula, was annexed by Russia in 2014. Two more, Donetsk and Luhansk, are largely held by pro-Russian separatists.

The country, Europe's poorest, is still facing sporadic breaches in its ceasefire with forces in Donetsk and Luhansk it believes are effectively proxies for the Kremlin regime of Vladimir Putin.

Yet Ukraine is fighting a war while public finances and economy crippled by decades of looting. Transparency International ranks the country, alongside with Russia and Kazakhstan, as the the most corrupt in Europe.

One rare perceived victory in the war on graft was the seizure of $1.5 billion linked to the circle of former President Viktor Yanukovych in a secret court case last year.

However, some of the "offshore" companies whose assets were confiscated are fighting through the courts to get them back. Yet, as they do so, there are claims there has been a fire sale of the firms subject to the seizure.

Al Jazeera Investigations in a new film called The Oligarchs report that one of the companies, Quickpace, has been sold out from under the seizure. The journalists believe one of the buyers of that firm was an exiled MP and former Olympic showjumper called Oleksandr Onyschenko, who formerly owned Kiev Arsenal football club and ran the Miss Ukraine beauty pageant.

In an interview, with the TV station he denied taking over Quickpace. Ukrainian authorities in 2016 froze $7m they linked to Onyschenko, who they accuse of skimming from gas sales. The money was accounts in the name of Onyschenko himself, a Scottish limited partnership and a Cypriot firm at two Latvian banks, one of them the Ukrainian-owned Privatbank. Onyschenko, a one-time political ally of ousted Yanukovych, insists he is innocent and that he fled his country because its current president, whom he has accused of corruption, planned to kill him.

The battle for Ukraine's frozen $1.5bn continues.

Al Jazeera's investigation is broadcast on Sunday at 8pm

Why are you making commenting on The Herald only available to subscribers?

It should have been a safe space for informed debate, somewhere for readers to discuss issues around the biggest stories of the day, but all too often the below the line comments on most websites have become bogged down by off-topic discussions and abuse.

heraldscotland.com is tackling this problem by allowing only subscribers to comment.

We are doing this to improve the experience for our loyal readers and we believe it will reduce the ability of trolls and troublemakers, who occasionally find their way onto our site, to abuse our journalists and readers. We also hope it will help the comments section fulfil its promise as a part of Scotland's conversation with itself.

We are lucky at The Herald. We are read by an informed, educated readership who can add their knowledge and insights to our stories.

That is invaluable.

We are making the subscriber-only change to support our valued readers, who tell us they don't want the site cluttered up with irrelevant comments, untruths and abuse.

In the past, the journalist’s job was to collect and distribute information to the audience. Technology means that readers can shape a discussion. We look forward to hearing from you on heraldscotland.com

Comments & Moderation

Readers’ comments: You are personally liable for the content of any comments you upload to this website, so please act responsibly. We do not pre-moderate or monitor readers’ comments appearing on our websites, but we do post-moderate in response to complaints we receive or otherwise when a potential problem comes to our attention. You can make a complaint by using the ‘report this post’ link . We may then apply our discretion under the user terms to amend or delete comments.

Post moderation is undertaken full-time 9am-6pm on weekdays, and on a part-time basis outwith those hours.

Read the rules hereLast Updated:

Report this comment Cancel