Alliance Trust has set up an independent inquiry into why share payments to its two former executives were set too high, and the calculation error spotted not by the auditors but by a shareholder.

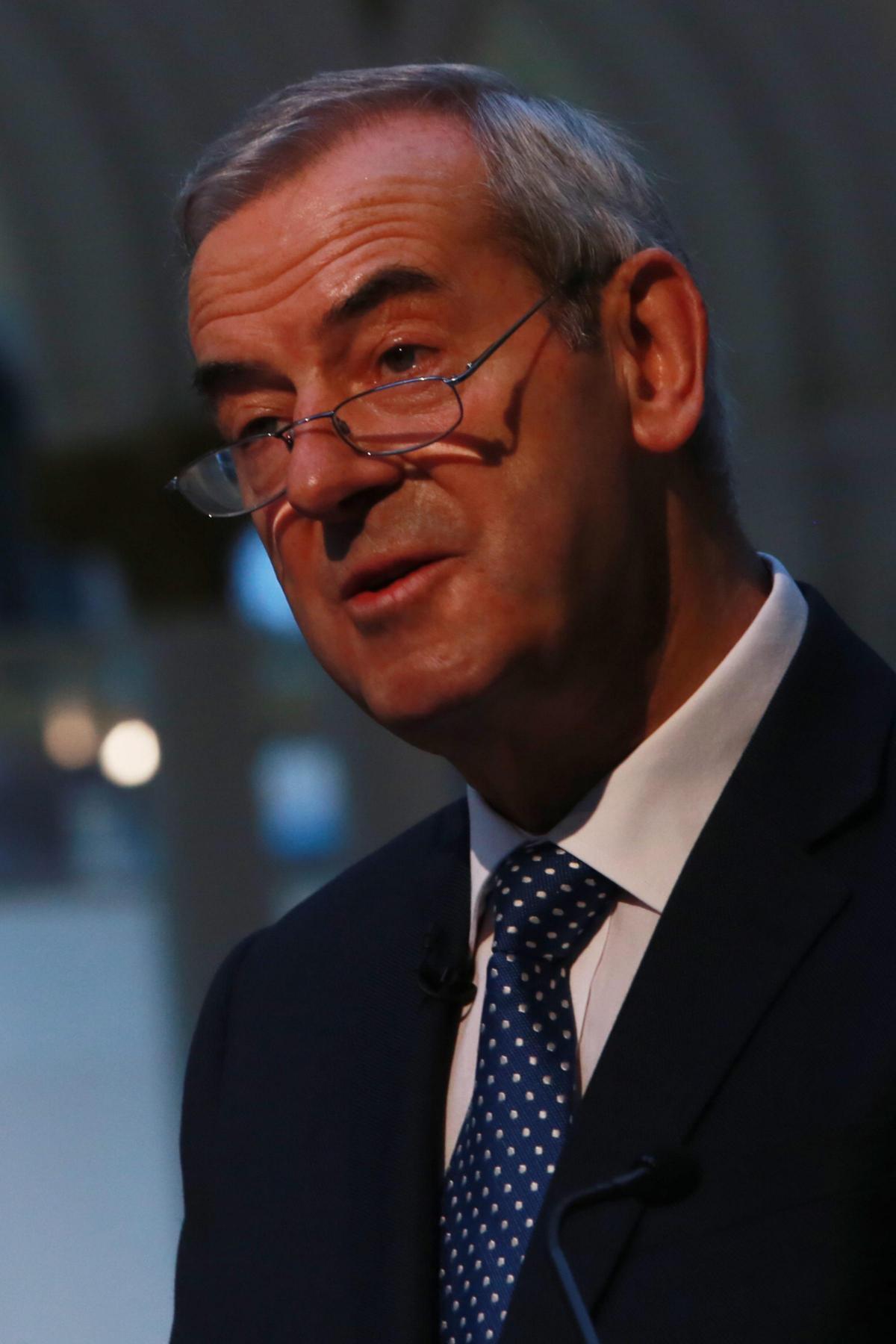

The admission came as the new chairman Lord Smith of Kelvin told the annual meeting in Dundee that the £2.8billion trust would in future be held to account for its investment performance and its loss-making subsidiaries.

Lord Smith told a subdued annual meeting in Dundee, the scene of shareholder attacks on the board in recent years, that the new non-executive board which last year ditched the powerful former chief executive Katherine Garrett-Cox was now “wholly independent”.

But he faced a series of probing questions from shareholders about the qualifications and commitment of the board, two of whom were nominated last year by activist shareholder Elliott Advisers as part of the trust’s overhaul, and about the company’s audit.

Lord Smith prefaced the open session by warning that the 2013 long-term incentive plan had paid out 32.5 per cent of the maximum, based on the trust’s performance, but “on investigation we agreed the vesting should be lower at 27 per cent....the rewards to participants were adjusted downwards before any shares were sold”. It meant the total rewards for Ms Garrett-Cox and former finance director Alan Trotter for 2015 had been “slightly overstated”.

But minutes later shareholder Douglas Wood said: “I understand the downward adjustment to the two executive directors was over £100,000, a little more significant than we were led to understand. A few years ago there was an error in bonus calculations which led to senior managers having to repay overpayments, this isn’t a good situation, it raises the risk of reputational damage.” Mr Wood went on: “The auditors are not picking up the errors.”

Asked by Lord Smith to comment, Calum Thomson of Deloittes said: “We tested bonuses on a sample basis, unfortunately they didn’t pick up the errors.”

MrWood responded: “I have been told by the company secretary that auditors checked the calculations.”

Gregor Stewart, deputy chairman, said: “We are committed to a full investigation of this...we aim to get to the bottom of it this time.”

Lord Smith said to Mr Wood: “Thank you for drawing it to our attention in the first place.”

Chairing a seven-man board, five of them new and replacing three women, Lord Smith said a female director was about to be appointed. The £120,000 a year chairman anticipated criticism of unreduced director fees by saying the trust’s overhaul was “demanding much more of directors’ time than would normally be the case”. He then alluded to Ms Garrett-Cox’s pay-off earlier this year , which amounted to £668,000 along with retained share options worth £2.5m. “The important point is we paid her the amount to which she was entitled under her contract and in law, no more and no less,” Lord Smith said.

When questions began, shareholder Jane Perry said: “My main concern with the previous chief executive was her seeming complete ignorance of what an investment trust is about, will the chairman consider some knowledge of investment trusts being a requirement for board directors?”

Lord Smith replied: “I think it’s a good idea. We will examine our requirements for future directors of the board.”

Challenged further on the relevance of the new directors’ experience to Alliance Trust, Lord Smith invited the directors in turn to justify their appointment.

Shareholder Michael Gibson commented later: “The board has been revolving for many years, directors have come and left again quite rapidly with no explanation to shareholders. Could you assure us that the current and new directors are here for the long haul?”

Lord Smith had begun by saying it was a “heart not head” commitment on his part to an important Scottish financial institution which nevertheless had needed to change. “I only took the role because I believed the plan was right and the team could deliver it,” he said. He told Mr Gibson he believed board colleagues were also committed for the long haul.

On the loss-making subsidiaries, the chairman said they now had independent boards, and Alliance Trust Savings management had been “challenged to deliver a profit in 2016”. The goal for Alliance Trust Investments was “to reach profitability”.

Why are you making commenting on The Herald only available to subscribers?

It should have been a safe space for informed debate, somewhere for readers to discuss issues around the biggest stories of the day, but all too often the below the line comments on most websites have become bogged down by off-topic discussions and abuse.

heraldscotland.com is tackling this problem by allowing only subscribers to comment.

We are doing this to improve the experience for our loyal readers and we believe it will reduce the ability of trolls and troublemakers, who occasionally find their way onto our site, to abuse our journalists and readers. We also hope it will help the comments section fulfil its promise as a part of Scotland's conversation with itself.

We are lucky at The Herald. We are read by an informed, educated readership who can add their knowledge and insights to our stories.

That is invaluable.

We are making the subscriber-only change to support our valued readers, who tell us they don't want the site cluttered up with irrelevant comments, untruths and abuse.

In the past, the journalist’s job was to collect and distribute information to the audience. Technology means that readers can shape a discussion. We look forward to hearing from you on heraldscotland.com

Comments & Moderation

Readers’ comments: You are personally liable for the content of any comments you upload to this website, so please act responsibly. We do not pre-moderate or monitor readers’ comments appearing on our websites, but we do post-moderate in response to complaints we receive or otherwise when a potential problem comes to our attention. You can make a complaint by using the ‘report this post’ link . We may then apply our discretion under the user terms to amend or delete comments.

Post moderation is undertaken full-time 9am-6pm on weekdays, and on a part-time basis outwith those hours.

Read the rules hereLast Updated:

Report this comment Cancel