WE celebrated another good week for our existing tips with the nominal purchase of shares in the fast-expanding veterinary group CVS on Wednesday morning.

It is something of a safety-first choice as the business appears immune from current economic uncertainties with customers ready to make sacrifices to ensure their pets get the best available treatment.

But we also like the prospects for fatter profits margins from a growing portfolio of own-label medicines and the economies of scale as directors add to their chain which already embraces nearly 400 branches, including six in the Netherlands.

We have set the usual stop loss target, some 10 per cent below the current share price, at which we advise followers to consider selling on any price reversal.

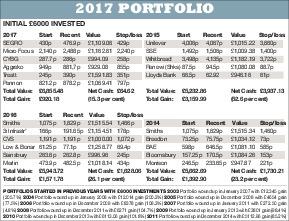

Most of our existing tips continued to enjoy a good run last week with average gains stretching to around 1.7 per cent when we carried out our mid-week review of progress, The best performance came from the 2017 portfolio which rose a further 2.6 per cent to a fresh peak valuation, boosted by solid investment support for the heavyweight Micro Focus ahead of its acquisition of a package of businesses from Hewlett Packard.

Loss-elimination also played a part with Clydesdale Bank owner CYBG moving closer to break-even and Scotland’s Aggreko managing to trim the deficit on its recommended purchase price.

The 2016 selections followed closely behind with a 2.5 per cent increase after a particularly good showing by Dundee registered floor coverings group Low & Bonar in the wake of strong ‘buy’ recommendation from brokers at Berenberg.

But the 2015 portfolio was held back by a sharp fall in the price of Lloyds Banking after the shares began trading without the benefit of the latest dividend and recorded only a modest 1 per cent increase despite good gains from heavyweights Unilever and Whitbread.

The 2017 list also lagged behind the others with a 0.6 per cent gain although four of the five recommendations gained some ground over the week.

Harry Potter publisher Bloomsbury was the exception and recorded a small fall ahead of next month’s annual results presentation.

Why are you making commenting on The Herald only available to subscribers?

It should have been a safe space for informed debate, somewhere for readers to discuss issues around the biggest stories of the day, but all too often the below the line comments on most websites have become bogged down by off-topic discussions and abuse.

heraldscotland.com is tackling this problem by allowing only subscribers to comment.

We are doing this to improve the experience for our loyal readers and we believe it will reduce the ability of trolls and troublemakers, who occasionally find their way onto our site, to abuse our journalists and readers. We also hope it will help the comments section fulfil its promise as a part of Scotland's conversation with itself.

We are lucky at The Herald. We are read by an informed, educated readership who can add their knowledge and insights to our stories.

That is invaluable.

We are making the subscriber-only change to support our valued readers, who tell us they don't want the site cluttered up with irrelevant comments, untruths and abuse.

In the past, the journalist’s job was to collect and distribute information to the audience. Technology means that readers can shape a discussion. We look forward to hearing from you on heraldscotland.com

Comments & Moderation

Readers’ comments: You are personally liable for the content of any comments you upload to this website, so please act responsibly. We do not pre-moderate or monitor readers’ comments appearing on our websites, but we do post-moderate in response to complaints we receive or otherwise when a potential problem comes to our attention. You can make a complaint by using the ‘report this post’ link . We may then apply our discretion under the user terms to amend or delete comments.

Post moderation is undertaken full-time 9am-6pm on weekdays, and on a part-time basis outwith those hours.

Read the rules here