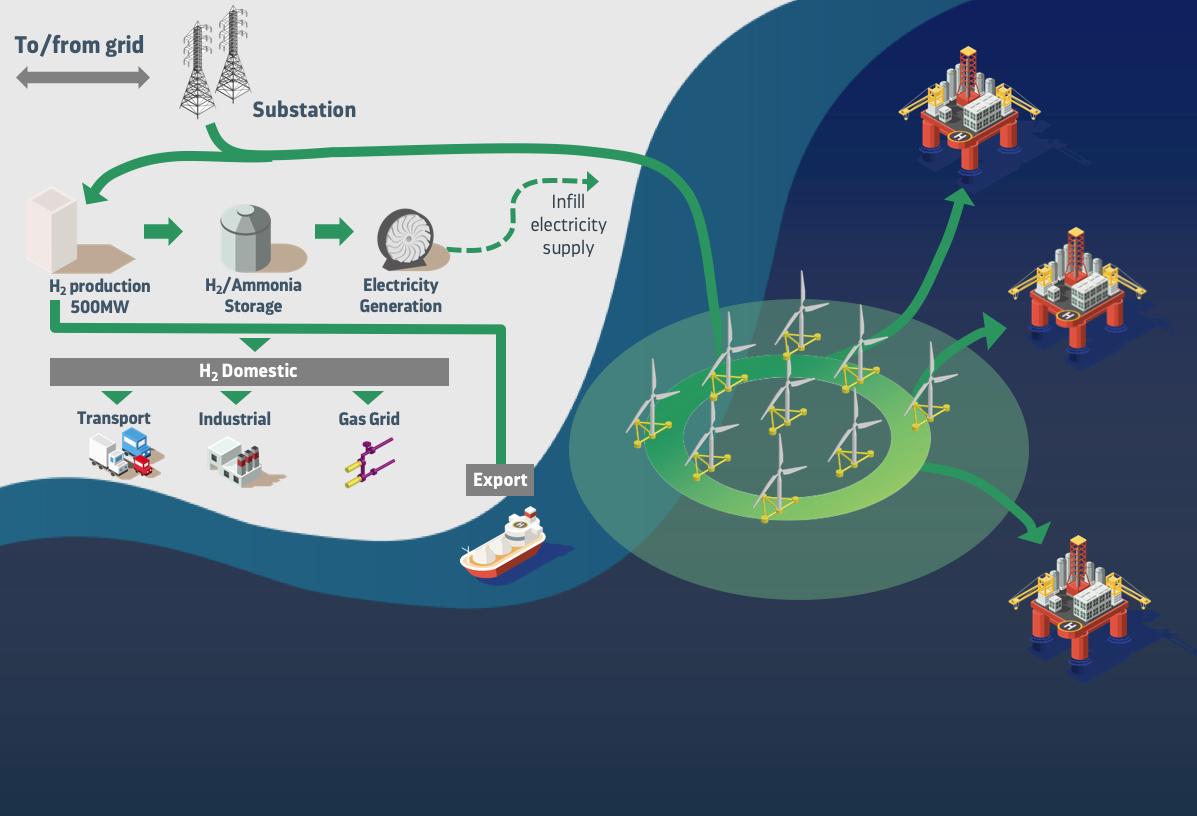

HUNDREDS of floating wind power turbines could be deployed in the North Sea under a plan that it is claimed could deal with the bulk of emissions associated with the production of oil and gas in the area.

The Cerulean Winds venture is seeking fast-track regulatory consent for a 200-turbine floating wind and hydrogen development it says will decarbonise the majority of United Kingdom Continental Shelf assets.

The £10 billion proposed “green infrastructure play” would involve putting huge floating windfarms in place West of Shetland and in the Central North Sea off the Scottish mainland.

READ MORE: Floating windfarm coup for Aberdeen engineering giant as interest in sector grows

Cerulean says the power from the windfarms would be sufficient to reduce emissions from UKCS oil and gas production assets well ahead of targets while leaving enough to power large-scale green hydrogen production facilities.

The project could help safeguard thousands of jobs.

Cerulean is led by oil services entrepreneurs Dan Jackson and Mark Dixon, who have worked on a wide range of North Sea developments.

After lining up leading oil services firms to work on the project and taking soundings among financial market players, the company is seeking clearance from the Scottish Government and Marine Scotland for the scheme.

It hopes to win clearance separately from the ScotWind licensing round that is being conducted by Crown Estate Scotland, which will cover acreage closer to the mainland than that Cerulean is eyeing.

Mr Jackson said: “The decision to proceed with the scheme will ultimately rest with the Scottish Government and Marine Scotland and their enthusiasm for a streamlined regulatory approach.”

READ MORE: Can renewables jobs make up for Scottish oil decline?

He added: “The UK is progressing the energy transition, but a sense of urgency and joined-up approach is required to enable rapid decarbonisation of oil and gas assets or there is a risk of earlier decommissioning and significant job losses.”

Cerulean said the proposed plan would not require subsidy support and could be expected to generate hundreds of millions of pounds revenue for the public sector through leases and taxation through to 2030.

Energy firms and financiers have made clear they think the UK offshore wind market is attractive. SSE chief executive Alistair Phillips-Davies said last week the energy giant could bid for acreage on which to deploy floating windfarms in the ScotWind round.

Why are you making commenting on The Herald only available to subscribers?

It should have been a safe space for informed debate, somewhere for readers to discuss issues around the biggest stories of the day, but all too often the below the line comments on most websites have become bogged down by off-topic discussions and abuse.

heraldscotland.com is tackling this problem by allowing only subscribers to comment.

We are doing this to improve the experience for our loyal readers and we believe it will reduce the ability of trolls and troublemakers, who occasionally find their way onto our site, to abuse our journalists and readers. We also hope it will help the comments section fulfil its promise as a part of Scotland's conversation with itself.

We are lucky at The Herald. We are read by an informed, educated readership who can add their knowledge and insights to our stories.

That is invaluable.

We are making the subscriber-only change to support our valued readers, who tell us they don't want the site cluttered up with irrelevant comments, untruths and abuse.

In the past, the journalist’s job was to collect and distribute information to the audience. Technology means that readers can shape a discussion. We look forward to hearing from you on heraldscotland.com

Comments & Moderation

Readers’ comments: You are personally liable for the content of any comments you upload to this website, so please act responsibly. We do not pre-moderate or monitor readers’ comments appearing on our websites, but we do post-moderate in response to complaints we receive or otherwise when a potential problem comes to our attention. You can make a complaint by using the ‘report this post’ link . We may then apply our discretion under the user terms to amend or delete comments.

Post moderation is undertaken full-time 9am-6pm on weekdays, and on a part-time basis outwith those hours.

Read the rules hereLast Updated:

Report this comment Cancel