Online retail company THG saw its shares slump by more than a fifth during trading after two suitors mulling bids worth more £2 billion and £1 billion walked away from the business.

Belerion Capital, a London-based e-commerce and technology investor, and Candy Ventures Sarl, the investment firm of billionaire British property investor, Nick Candy, both announced they would not be proceeding with bids for the e-commerce specialist.

In its own statement, Manchester-based THG, previously known as The Hut Group, said it had received proposed bids from “numerous parties” in recent months. But none of these was acceptable.

“All recent approaches for THG have been unsolicited, and in the unanimous opinion of the board, were unacceptable and significantly undervalued the company,” the board said.

THG, which has around 10,000 staff and was valued at £4.5 billion when it first floated on the London Stock Exchange in September 2020, said it had not opened its books to any of the suitors.

“After consulting with THG’s major shareholders and taking advice from the company’s advisors, the board has not considered it appropriate to provide due diligence access to any of these parties,” THG said.

THG manufactures and sells beauty and nutrition products through its own websites, including LookFantastic, MyProtein and Dermstore. It also operates hundreds of retail websites around the world for companies including Homebase, Nestle, Proctor & Gamble and Johnson & Johnson.

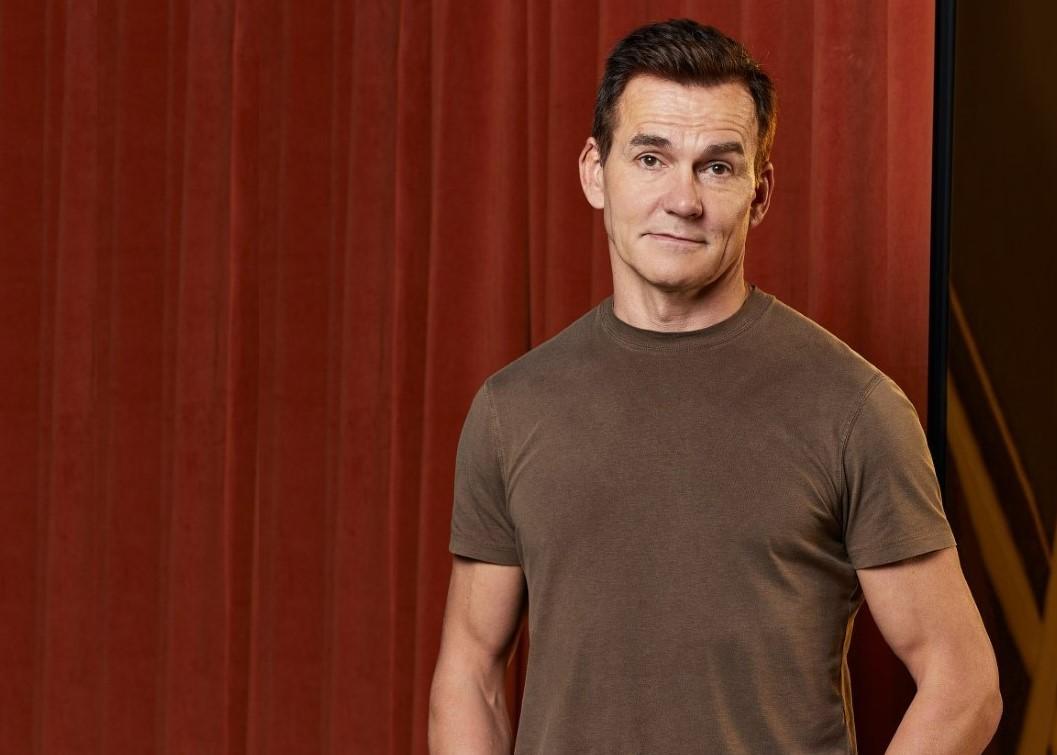

One of THG’s investors is Scottish entrepreneur Sir Tom Hunter. His West Coast Capital investment group first invested in The Hut Group in 2010 and currently holds a 1.39% stake – 17.26 million shares – making it THG’s 16th-biggest investor.

Other investors include former Tesco chief executive Sir Terry Leahy, with a 1.29% stake – 16.09 million shares.

THG founder and chief executive Matthew Moulding is the company’s biggest investor, with a 14.69% stake.

The company has faced criticism over its governance structure – including Mr Moulding previously holding the roles of both chairman and chief executive.

Mr Moulding also previously held a controversial ‘golden share’ in THG that allowed him to veto any takeover attempts – but also barred the company from joining FTSE indices.

This has troubled investors, alongside worries about future prospects, and in 2021 THG lost more than £2 billion of its stock market value.

Mr Moulding surrendered his golden share in October 2021, and in March this year, THG hired former ITV boss Charles Allen as its non-executive chairman.

In May, THG announced it had rejected a £2.1 billion approach from a consortium led by Belerion and King Street Capital Management, an alternative asset manager based in New York.

Under UK Takeover Panel rules, potential bidders had until 4pm on Thursday 16 June to make a formal offer for THG or walk away.

Belerion Capital said it and King Street Capital did not intend to make an offer for THG. Candy Ventures, which was reported last month to be considering a £1.4 billion bid for THG, also confirmed it did not intend to make an offer.

THG said that it was “clearly aware” of wider macro-economic challenges, but that the company continued to “perform well, and in line with its own expectations.”

At its annual results in April, THG said revenues in 2021 rose 35% on the year before to £2.18 billion, while pre-tax losses narrowed to £186.3m from £534.6 previously. But shares at the time slid sharply after the company warned that profit margins for the year would be lower than expected.

THG also said the war in Ukraine, Covid-19 related lockdowns in Asia and inflationary pressure across almost all cost lines meant 2022 would be tougher.

Mr Moulding qualified as a chartered accountant with Arthur Andersen and was previously chief financial officer at the distribution division of telecoms company The Caudwell Group, founded by Phones 4U entrepreneur John Cauldwell.

Why are you making commenting on The Herald only available to subscribers?

It should have been a safe space for informed debate, somewhere for readers to discuss issues around the biggest stories of the day, but all too often the below the line comments on most websites have become bogged down by off-topic discussions and abuse.

heraldscotland.com is tackling this problem by allowing only subscribers to comment.

We are doing this to improve the experience for our loyal readers and we believe it will reduce the ability of trolls and troublemakers, who occasionally find their way onto our site, to abuse our journalists and readers. We also hope it will help the comments section fulfil its promise as a part of Scotland's conversation with itself.

We are lucky at The Herald. We are read by an informed, educated readership who can add their knowledge and insights to our stories.

That is invaluable.

We are making the subscriber-only change to support our valued readers, who tell us they don't want the site cluttered up with irrelevant comments, untruths and abuse.

In the past, the journalist’s job was to collect and distribute information to the audience. Technology means that readers can shape a discussion. We look forward to hearing from you on heraldscotland.com

Comments & Moderation

Readers’ comments: You are personally liable for the content of any comments you upload to this website, so please act responsibly. We do not pre-moderate or monitor readers’ comments appearing on our websites, but we do post-moderate in response to complaints we receive or otherwise when a potential problem comes to our attention. You can make a complaint by using the ‘report this post’ link . We may then apply our discretion under the user terms to amend or delete comments.

Post moderation is undertaken full-time 9am-6pm on weekdays, and on a part-time basis outwith those hours.

Read the rules here