Inflation unexpectedly held steady last month as food prices fell for the first time in almost two-and-a-half years, official figures show.

Consumer Prices Index (CPI) inflation remained unchanged at 4% in January, lower than the 4.2% that economists had forecast although still double the Bank of England’s 2% target, the Office for National Statistics (ONS) said.

The monthly drop in food prices, of 0.4%, was the first since September 2021, with the cost of bread and cereals, cream crackers and chocolate biscuits falling, the ONS said.

While food and non-alcoholic beverage prices are still 7% higher than a year ago, the category saw the slowest rate of increase since April 2022.

On a monthly basis, food and non-alcoholic beverage prices fell by 0.4% between December and January.

Most of this drop was down to a 1.3% decrease in bread and cereal prices – the largest in that category since May 2021.

READ MORE: Are great expectations due for Scotland's economy?

The ONS said seven out of 11 types of food and non-alcoholic beverages it tracks put downward pressure on the inflation figure last month.

Despite the most recent fall, food and non-alcoholic beverages are around 25% more expensive than they were in January 2022. In the entire decade before that, prices only rose around 10%.

ONS chief economist Grant Fitzner said: “Inflation was unchanged in January, reflecting counteracting effects within the basket of goods and services.

“The price of gas and electricity rose at a higher rate than this time last year due to the increase in the energy price cap, while the cost of second-hand cars went up for the first time since May.

“Offsetting these, prices of furniture and household goods decreased by more than a year ago and food prices fell on the month for the first time in over two years.

“All of these factors combined resulted in no change to the headline rate this month.”

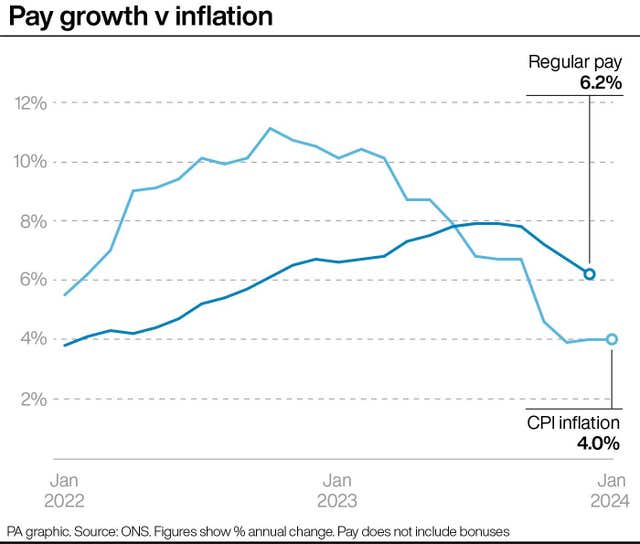

(PA Graphics)

(PA Graphics)

Chancellor Jeremy Hunt said: “Inflation never falls in a perfect straight line, but the plan is working. We have made huge progress in bringing inflation down from 11%, and the Bank of England forecast that it will fall to around 2% in a matter of months.”

Shadow chancellor Rachel Reeves said: “After 14 years of economic failure, working people are worse off. Prices are still rising in the shops, with the average household’s costs up £110 a week compared to before the last election.

“Inflation is still higher than the Bank of England’s target and millions of families are struggling with the cost of living.

“The Conservatives cannot fix the economy because they are the reason it is broken. It’s time for change. Only Labour has a long-term plan to get Britain’s future back by delivering more jobs, more investment and cheaper bills.”

READ MORE: Growth will be the litmus test in the next General Election

Economists’ thoughts immediately turned to what this could mean for the Bank of England’s decisions in the months ahead.

The Bank had forecast that inflation would be 4.1% last month, so it might conclude that its measures to combat inflation are working better than previously thought. Interest rates are currently at their highest levels in 16 years in order to keep a lid on runaway inflation.

So the surprise figures on Thursday increase the likelihood of the Bank cutting interest rates sometime in the first half of this year, said Samuel Tombs, chief UK economist at Pantheon Macroeconomics.

“We continue to think that CPI outturns over the coming months will convince the (Bank’s Monetary Policy Committee) in the second quarter that monetary policy does not need to be quite as ‘restrictive’ as it is currently, though it looks like a toss-up whether the committee will opt to cut Bank rate for the first time in May or June,” he said.

As markets opened on Wednesday morning traders seemed optimistic, sending the FTSE 100 up by around 0.5%.

Why are you making commenting on The Herald only available to subscribers?

It should have been a safe space for informed debate, somewhere for readers to discuss issues around the biggest stories of the day, but all too often the below the line comments on most websites have become bogged down by off-topic discussions and abuse.

heraldscotland.com is tackling this problem by allowing only subscribers to comment.

We are doing this to improve the experience for our loyal readers and we believe it will reduce the ability of trolls and troublemakers, who occasionally find their way onto our site, to abuse our journalists and readers. We also hope it will help the comments section fulfil its promise as a part of Scotland's conversation with itself.

We are lucky at The Herald. We are read by an informed, educated readership who can add their knowledge and insights to our stories.

That is invaluable.

We are making the subscriber-only change to support our valued readers, who tell us they don't want the site cluttered up with irrelevant comments, untruths and abuse.

In the past, the journalist’s job was to collect and distribute information to the audience. Technology means that readers can shape a discussion. We look forward to hearing from you on heraldscotland.com

Comments & Moderation

Readers’ comments: You are personally liable for the content of any comments you upload to this website, so please act responsibly. We do not pre-moderate or monitor readers’ comments appearing on our websites, but we do post-moderate in response to complaints we receive or otherwise when a potential problem comes to our attention. You can make a complaint by using the ‘report this post’ link . We may then apply our discretion under the user terms to amend or delete comments.

Post moderation is undertaken full-time 9am-6pm on weekdays, and on a part-time basis outwith those hours.

Read the rules here