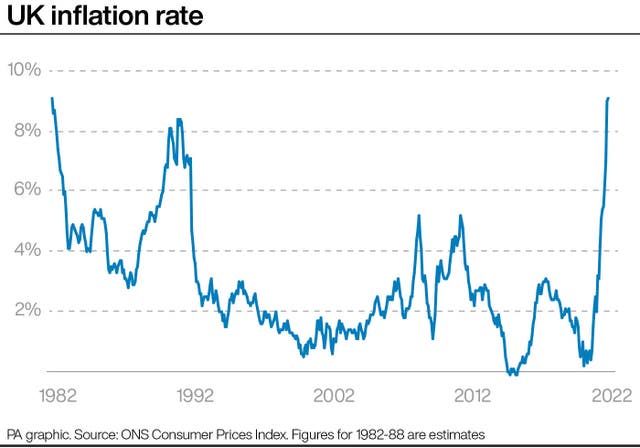

The rate of inflation rose again in May, remaining at 40-year highs and deepening the squeeze felt by households across the UK, the Office for National Statistics (ONS) has said.

The rate of consumer prices index (CPI) inflation rose from 9% in April to 9.1% in May, the statisticians said.

The increase matches what analysts had expected and pushes the measure to its highest since early 1982, according to ONS estimates.

Scottish Finance Secretary Kate Forbes said that the outlook was "extremely worrying" and warned that inflation could push higher in the coming months.

She said: “What’s even more concerning is the bank of England are predicting it will continue to rise, reaching double figures in the Autumn.

“And we also know that the inflation rate is essentially higher for the poorest households because there is a greater component of their weekly bill that’s spent on food, on fuel - which is where we are seeing the highest price increases.”

(PA Graphics)

(PA Graphics)

“Though still at historically high levels, the annual inflation rate was little changed in May,” said ONS chief economist Grant Fitzner.

“Continued steep food price rises and record high petrol prices were offset by clothing costs rising by less than this time last year, and a drop in often fluctuating computer games prices.

“The price of goods leaving factories rose at their fastest rate in 45 years, driven by widespread food price rises, while the cost of raw materials leapt at their fastest rate on record.”

The change was in large part driven by the increase in food prices, which added more than 0.2 percentage points to the inflation number, the ONS said.

Grant Fitzner also said: (3/3)

— Office for National Statistics (ONS) (@ONS) June 22, 2022

Clothing and footwear prices helped keep a lid on inflation, while recreation and culture prices also pulled it downwards.

The news will add to the difficulties faced by many people across the UK. Energy bills rose by 54% for the average household at the beginning of April and will remain at this level until October.

But forecasts released this week predict that the Government cap on energy bills could rise again from an already record high £1,971 to £2,980 in the autumn.

The Bank of England has predicted that inflation will spike at more than 11% in October after the price cap is changed again.

Speaking to the BBc this morning Kate Forbes said that a "myriad" of support had been developed to help families feeling the strain in Scotland, but added that the major levers of the economy were still reserved to Westminster.

She said: “At the moment the key is trying to provide as much cash support, and other forms of support, on a very targeted basis to those households that need it.

“Everybody is contending with increases. But quite clearly those that are earning the least are facing the greatest challenges.

“So in Scotland, in this year’s budget, we have taken a number of steps. We’ve uprated all social security benefits at the rate of inflation at the time of the budget."

She added: “And we’ve also provided additional support through things like the Scottish child payment to reduce the overall costs of raising a child.”

“There’s a myriad form of support, but that doesn’t take away from the fact that families are struggling and ultimately the UK Government … hold most of the powers needed to tackle this: Powers over energy powers over the minimum wage, powers over social security spending.

Shadow chancellor Rachel Reeves said: “Today’s rising inflation is another milestone for people watching wages, growth and living standards continue to plummet.

“Though rapid inflation is pushing family finances to the brink, the low wage spiral faced by many in Britain isn’t new.

“Over the last decade, Tory mismanagement of our economy has meant living standards and real wages have failed to grow.”

Chancellor Rishi Sunak said: “I know that people are worried about the rising cost of living, which is why we have taken targeted action to help families, getting £1,200 to the eight million most vulnerable households.

“We are using all the tools at our disposal to bring inflation down and combat rising prices – we can build a stronger economy through independent monetary policy, responsible fiscal policy which doesn’t add to inflationary pressures, and by boosting our long-term productivity and growth.”

The price of energy is not just feeding through to household energy bills.

Gas, oil and other fossil fuels are needed to make and transport many of the goods that households buy every month.

When the price of the fuel goes up, so does the price of the end product.

Energy prices have spiked over the last year. To begin with they started rising as the global economy started to reopen and demand for energy rose after the pandemic.

The Consumer Prices Index including owner occupiers’ housing costs grew 7.9% in the year to May 2022, up from 7.8% in the year to April https://t.co/xSN9anxUkm

— Office for National Statistics (ONS) (@ONS) June 22, 2022

The prices later worsened, especially in Europe, when Russia launched a full-scale invasion of Ukraine in February.

Russia is one of the world’s largest energy producers.

A breakdown from the ONS shows that the biggest increases in the 12 months to May were for fossil fuel products, including diesel, electricity, petrol and natural gas. These were, however, little changed from April.

Some of the biggest changes from April were food items. Ukraine is one of the biggest grain producers in the world and experts worried about what the war could do to global prices and availability.

The price of flour and other cereals in the UK had been decreasing before the war started, but has been ticking up since.

Between February and April price rises increased from 2.3% to 9.3%. But in May prices leaped and are now 16.3% higher than a year ago.

Price rises of olive oil also accelerated from 9.5% in April to 18% in May, the ONS said.

The statisticians said that the consumer prices index including owner occupiers’ housing costs (CPIH) rose by 7.9% in May from 7.8% in April.

The retail prices index, which is used to calculate train fares, rose from 11.1% in April to 11.7% in May.

Why are you making commenting on The Herald only available to subscribers?

It should have been a safe space for informed debate, somewhere for readers to discuss issues around the biggest stories of the day, but all too often the below the line comments on most websites have become bogged down by off-topic discussions and abuse.

heraldscotland.com is tackling this problem by allowing only subscribers to comment.

We are doing this to improve the experience for our loyal readers and we believe it will reduce the ability of trolls and troublemakers, who occasionally find their way onto our site, to abuse our journalists and readers. We also hope it will help the comments section fulfil its promise as a part of Scotland's conversation with itself.

We are lucky at The Herald. We are read by an informed, educated readership who can add their knowledge and insights to our stories.

That is invaluable.

We are making the subscriber-only change to support our valued readers, who tell us they don't want the site cluttered up with irrelevant comments, untruths and abuse.

In the past, the journalist’s job was to collect and distribute information to the audience. Technology means that readers can shape a discussion. We look forward to hearing from you on heraldscotland.com

Comments & Moderation

Readers’ comments: You are personally liable for the content of any comments you upload to this website, so please act responsibly. We do not pre-moderate or monitor readers’ comments appearing on our websites, but we do post-moderate in response to complaints we receive or otherwise when a potential problem comes to our attention. You can make a complaint by using the ‘report this post’ link . We may then apply our discretion under the user terms to amend or delete comments.

Post moderation is undertaken full-time 9am-6pm on weekdays, and on a part-time basis outwith those hours.

Read the rules hereLast Updated:

Report this comment Cancel